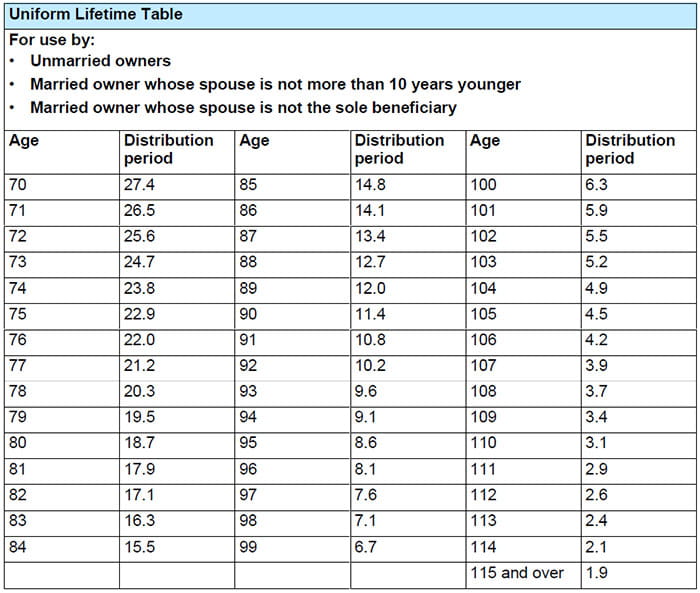

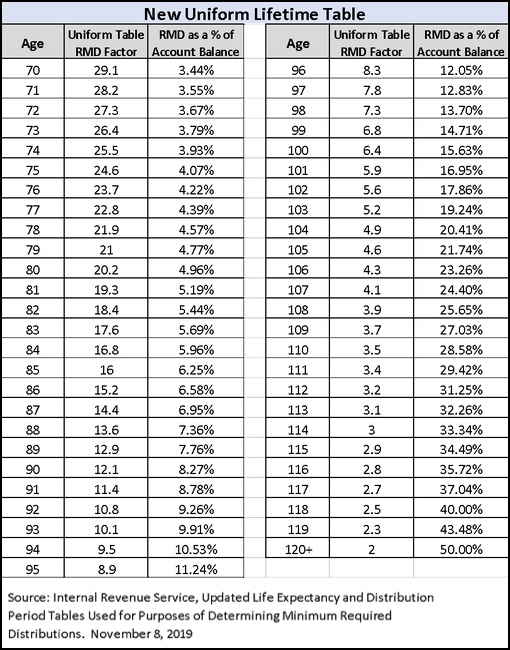

Inherited Rmd Calculator 2025 Irs. If you've inherited an ira and are required to take annual distributions, also known as required minimum distributions (rmds), use our calculator to determine how much you need to withdraw from the account each year to avoid penalties. We'll tell you what you.

2025 Inherited Ira Rmd Calculator Val Libbie, 36 rows this calculator determines the minimum required distribution (known as both rmd or mrd, which is really confusing!) from an inherited ira based on the irs single life expectancy.

Irs Rmd Tables 2025 For Inherited Ira Janel Melisande, By changing any value in the following form.

Inherited Rmd Calculator 2025 Table Leela Kellyann, If inherited assets have been transferred into an inherited ira in your name, this calculator may help determine how much may be required to withdraw this year from the inherited account.

Inherited Rmd Calculator 2025 Table Leela Kellyann, An rmd is the minimum amount that the irs requires you to withdraw from your inherited ira each year depending on your age and beneficiary status.

Rmd Formula For 2025 Judye Gabriella, Under new guidance, beneficiaries inheriting from someone who had already started rmds must continue taking annual distributions.

Irs Rmd Calculator 2025 Table Fanya Persis, If you didn’t move your inherited assets into an inherited ira in your name in a timely manner, you must calculate rmd withdrawals using the age of the oldest beneficiary on the account as of.